Looking back, was TRID worth it to the consumer?

As we mentioned earlier (Let's put TRID to the test), we thought it might be time to ask the borrower—the intended beneficiary of the CFPB’s new TRID rule—if that rule had, indeed, made a positive effect upon their home loan experiences. You’ll recall that TRID was engineered by the CFPB, primarily, to prevent surprises (especially as to the settlement fees) at the closing table by driving better communication and collaboration between lender and title company. You may also recall that the months leading up to and the months immediately after the deadline for implementation (October, 2015) were, for many, a tad…um…apocalyptic hectic.

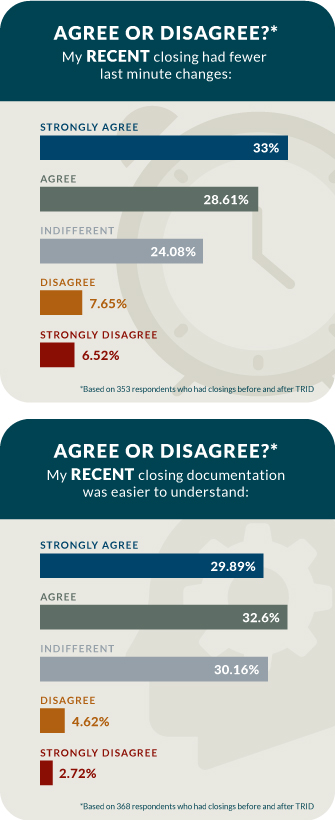

Let’s start with a look at the questions and response breakdowns. Keep in mind that this is a sample size of over 300 consumers who had just completed a refinance transaction (after October, 2015, thus, under the requirements of TRID) who had also refinanced a home loan prior to October, 2015 (a non-TRID closing).

So, let’s break this down a bit. If the easiest way to prevent surprises at the closing table is to reduce or eliminate last minute changes to the Lender Estimate, TRID has been a success so far—at least with our clients’ borrowers. Almost 62% responded that they either agree or strongly agree with the statement that the TRID closing had fewer changes than the previous, non-TRID closing. Another 24.5% were indifferent to the same statement, leaving only about 14% to disagree or strongly disagree with the same premise. It would seem, based upon our survey, that if TRID isn’t a raging success, it doesn’t seem to have caused a perception of harm to the consumer, either.

So, let’s break this down a bit. If the easiest way to prevent surprises at the closing table is to reduce or eliminate last minute changes to the Lender Estimate, TRID has been a success so far—at least with our clients’ borrowers. Almost 62% responded that they either agree or strongly agree with the statement that the TRID closing had fewer changes than the previous, non-TRID closing. Another 24.5% were indifferent to the same statement, leaving only about 14% to disagree or strongly disagree with the same premise. It would seem, based upon our survey, that if TRID isn’t a raging success, it doesn’t seem to have caused a perception of harm to the consumer, either.

Another goal of TRID (and, indeed, a recurring goal for CFPB in all that it does) was to increase the transparency of the process for the consumer. Again, over 60% of our respondents agreed or strongly agreed that their TRID closing experiences included documentation that was easier to understand. Only a little less than 8% disagreed with the premise that TRID documentation was easier to comprehend.

So there you have it. At least for the 300 or so borrowers working with Equity National Title recently who had a frame of reference for pre-TRID and post-TRID closings, the CFPB seems to be successfully herding the process toward more transparency and fewer surprises for the consumer. The more notable numbers indicate that, at the very least, TRID didn’t make these things worse for consumers.

So was the pain of transition for the industry worth it? We’ll need a more in-depth survey (more questions, more consumers) to make that judgment. But the early results would suggest so…

By: Equity National Title March 13, 2017 Mortgage, TRID, Loan Officers, Closings, Borrowers, Lenders A Closer Look

0 Comments

Add new comment